Tax laws are changing rapidly, and our team is working hard to break down the complex and constantly evolving laws, regulations, and guidelines to implement valuable strategies for each of your individual tax scenarios. Our tax planning strategy starts with your short-term and long-term goals and frequently includes recommendations for retirement planning. Who doesn’t love planning and preparing for retirement, with a side of major tax savings? We call it tax self-care.

We hope that this article, with general tax planning tips for 2022 – and a look ahead to 2023 – compliment the tax planning work we’ve prepared for you. Please let us know if you would like to cover any of these topics in further detail together.

Health Savings Accounts

Triple tax-advantage? Yes, please! HSA contributions are tax-deductible, the money grows tax-free, and withdrawals are tax-free when used for qualified medical expenses. If you are over 65, withdrawals for any purpose, while taxable, are not subject to penalties. One way to look at these accounts is as an IRA for health care costs. Consider investing for the long-term: Contribute annually but don’t use the funds for medical expenses when you are younger. Save the funds for your older years when you’ll be incurring the majority of your medical expenses. These accounts require that you have a high-deductible health insurance plan, so check with your insurance company prior to opening one of these accounts. Maximum contributions for 2022 are $3,650 (Self-only) and $7,300 (Family).

Loss-harvesting

It’s fair to say that 2022 hasn’t been a good year for stock markets, so consider selling securities that will produce a loss. These losses will offset investment gains and up to $3,000 of your other income (wages, business income, etc.). Any losses you did not utilize this year will carry forward to future years.

Charitable donations

This has become one of the most effective ways for individuals to utilize personal expenses as a tax deduction. Since the passage of the TCJA, most personal expenses are either subject to limitations (medical and taxes) or are non-deductible. If you find yourself in a high-income year, or are on the cusp of itemizing, consider increasing donations.

529 plans for education

These plans are a great way to save for future education costs. While contributions to these plans are not deductible on your federal return (many states, including Arizona, have a deduction) the money grows tax-free and distributions for qualifying educational expenses are not taxable. And, in addition to higher education costs, funds in these accounts can be used to cover private school tuition of up to $10,000 per year.

The Pass-Through Entity Level Tax (PTET)

A SALT Limitation Workaround: The Tax Cuts and Jobs Act placed a cap of $10,000 on deductible taxes on individual taxpayers who itemize their deductions. Most states have enacted or proposed legislation that allows individuals with pass-through entities to pay and deduct state taxes on their share of pass-through income. This tax has effectively circumvented this limitation.

Qualified charitable distributions

Are you required to make distributions from your IRA but don’t want to? If you are 70½ or older, you have the option to transfer up to $100,000 of your IRA distribution to a charity. Any donation amounts up to $100,000 are treated as non-taxable to you. Additionally, if you are 72 or older, your QCD counts toward your required minimum distribution for the year.

Timing

If you have control over when to pay a deductible expense or generate taxable income, now is a great time to think about tax rates! (Everybody’s favorite subject, no doubt.) The general idea here is to move income into years (whether that be this year or a future year) where you expect to be in a lower tax bracket. The opposite is true of deductible expenses. Since 1993, the highest marginal rates have remained consistent – between 35% and 39.6% – but they reached 94% in 1945 and 1946.

IRAs

Don’t have a retirement plan through your employer? Consider making traditional or Roth IRA contributions. Contributions to traditional IRAs are tax deductible, grow tax-free, but are taxable when withdrawn. Contributions to Roth IRAs, on the other hand, are NOT deductible but these receive tax-free growth and are not taxable when withdrawn. If you are in a high-income year or expect to be in a lower tax bracket when you retire, traditional IRAs often make more sense. If you are in a low-income year or expect to be in a higher tax bracket when you retire, Roth’s are a common way to go. Converting your traditional IRAs to Roth IRAs are also worth considering in low-income years.

Reminders

If you have a business, make sure you are maximizing your retirement plan contributions. Also, 2022 is the last year for 100% deductions for meals provided by restaurants. In 2023, these expenditures return to 50% deductibility.

What’s next?

Keep reading to see what the future holds! Well, at least in the tax world.

2023 & Beyond

Looking ahead, 2023 lacks any of the “major” changes of recent years but there are a few items that are worth shedding some light on.

Inflation adjustments

The IRS released the tax inflation adjustments for 2023 and while these increases are standard year-to-year, this year’s increase is notably high at about 7%. Wider tax brackets and increased exemptions and credits are welcomed by taxpayers after fighting through high inflation. The standard deduction will increase for single filers by $900 and joint filers by $1,800. Additionally, the IRS has increased the income thresholds for 2023 tax brackets. The good news is that if your total income doesn’t change from 2022 to 2023, you will pay less in taxes!

401(k) Contributions

Additionally, contributions to 401(k) plans will increase to $22,500 from $20,500, a significant year-over-year increase.

HSA Contributions

Contributions to health savings accounts will also increase to $3,850 (self-only) and $7,750 (Family), up from $3,650 and $7,300, respectively.

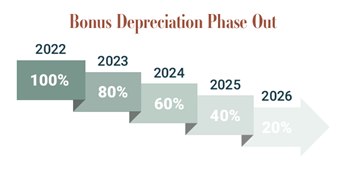

Bonus Depreciation

In 2023 we’ll begin to see changes to Bonus Depreciation (taking accelerated depreciation to write off your asset quicker than usually allowed). The Tax Cuts and Jobs Act increased first-year depreciation to 100%, which has remained in place through 2022. Businesses should plan for the decrease in bonus depreciation in 2023, as the maximum allowable amount falls to 80%. This 20% haircut will repeat annually until we reach a maximum of 20% in 2026. If you’re planning on investing in new equipment, vehicles, or other major assets, consider placing them in service before 12/31/22 to take advantage of 100% bonus depreciation.

Inflation Reduction Act

The tax benefits of the Inflation Reduction Act will go into effect in 2023. While most of the provisions of this bill are aimed at large and/or foreign corporations, there are some energy-related credits available to individuals. Provisions include:

- Extension, Increase, and Modifications of Nonbusiness Energy Property Credit.

- Extension and Modification of Residential Clean Energy Credit.

- Extension, Increase, and Modifications of New Energy Efficient Home Credit.

- New Clean Vehicle Credit.

- Credit for Previously-Owned Clean Vehicles.

- New Credit for Qualified Commercial Clean Vehicles.

- Increase in Qualified Small Business Payroll Tax Credit for Increasing Research Activities.

- Extension of Incentives for Biodiesel, Renewable Diesel and Alternative Fuels.

The details of these credits can be involved and technical, so let us know if you have questions about any of them.