Rising inflation and the high interest rate environment in 2023 have likely affected your general life this year, and has become critical for cash flow considerations with our clients. It has also contributed to tax bracket adjustments (outlined below), however basic income-tax rates (set with the enactment of the Tax Cuts and Jobs Act of 2017) did not change in 2023.

With the volatility of this year’s market many have seen a decrease in the value of their portfolios and we are reviewing taxpayer scenarios on a case-by-case basis to analyze if harvesting losses makes sense. If there is a decision to sell loss stock in 2023, individuals should remember that capital losses can be used only to offset realized capital gain and an additional $3,000 of ordinary income each year.

For tax year 2023, the standard deduction for married couples will increase to $27,700, or $1,800 higher than in the 2022 tax year; for single taxpayers and married individuals filing separately, it will rise to $13,850, or an increase of $900. Looking ahead to 2024, we will see a 5% increase in the standard deduction – making it $14,600 for single-filers and $29,200 for joint.

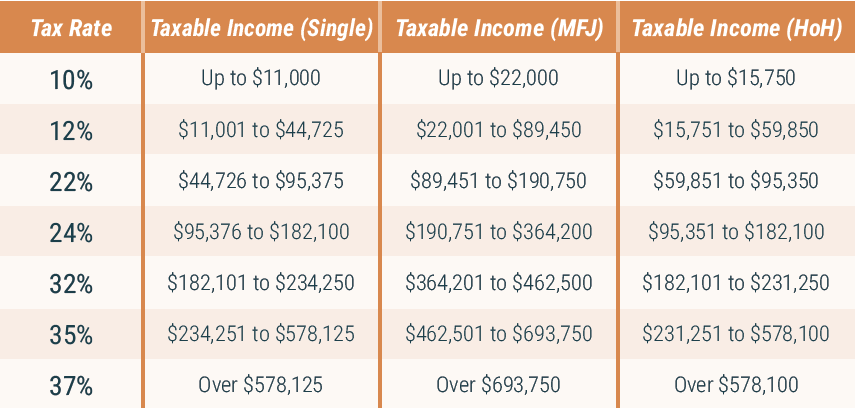

Income Tax Bracket Updates

While the IRS didn’t change the tax rates, the income tax brackets for 2023 have become much wider than they were in 2022. This adjustment is calculated based on inflation during the year.

401(k) Contributions

For 2023 the maximum contribution to 401(k) plans will increase to $22,500 from $20,500, a significant year-over-year increase. If you were born before 1974 (age 50) a catch-up contribution of up to $7,500 can be made, up from $6,500 in 2022.

IRAs

Don’t have a retirement plan through your employer? Consider making traditional or Roth IRA contributions. Contributions to traditional IRAs are tax deductible, grow tax-free, but are taxable when withdrawn. Contributions to Roth IRAs, on the other hand, are NOT deductible but these receive tax-free growth and are not taxable when withdrawn. If you are in a high-income year or expect to be in a lower tax bracket when you retire, traditional IRAs often make more sense. If you are in a low-income year or expect to be in a higher tax bracket when you retire, Roth’s are a common way to go. Converting your traditional IRAs to Roth IRAs are also worth considering in low-income years.

HSA Contributions

Contributions to health savings accounts have increased to $3,850 (self-only) and $7,750 (Family), up from $3,650 and $7,300 in 2022, respectively.

Estate Planning

For those concerned with estate planning, the gift tax annual exclusion limit for 2023 is $17,000 per person (or $34,000 for married couples). You could gift that amount from assets in your estate to any number of individuals, without triggering the gift tax. Another strategy that does not use any exemption amount is the direct payment of tuition and medical expenses. These payments do not count as a taxable gift or use any of the exemption amount as long as the payments are made directly to the institution. These can be made on anyone’s behalf and are not limited to immediate family members.

Inflation Reduction Act

The tax benefits of the Inflation Reduction Act have gone into effect in 2023. While most of the provisions of this bill are aimed at large and/or foreign corporations, there are some energy-related credits available to individuals. Provisions include:

- Extension, Increase, and Modifications of Nonbusiness Energy Property Credit.

- Extension and Modification of Residential Clean Energy Credit.

- Extension, Increase, and Modifications of New Energy Efficient Home Credit.

- New Clean Vehicle Credit.

- Credit for Previously-Owned Clean Vehicles.

- New Credit for Qualified Commercial Clean Vehicles.

- Increase in Qualified Small Business Payroll Tax Credit for Increasing Research Activities.

- Extension of Incentives for Biodiesel, Renewable Diesel and Alternative Fuels.

The details of these credits can be involved and technical, so let us know if you have questions about any of them.

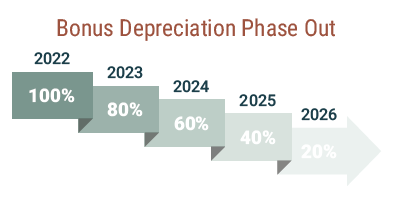

Bonus Depreciation

In 2023 we’ll begin to see changes to Bonus Depreciation (taking accelerated depreciation to write off your asset quicker than usually allowed). The Tax Cuts and Jobs Act increased first-year depreciation to 100%, which ended in 2022. For 2023 the maximum allowable amount falls to 80%. This 20% haircut will repeat annually until we reach a maximum of 20% in 2026.

Long-term Capital Gains Tax Rates

Like the tax rates, the long-term capital gains rates did not change but the income thresholds were adjusted for inflation.

In 2023, the 0% rate applies for individual taxpayers with taxable income up to $44,625 on single returns ($41,675 for 2022), $59,750 for head-of-household filers ($55,800 for 2022), and $89,250 for joint returns ($83,350 for 2022).

The 20% rate for 2023 starts at $492,301 for singles ($459,751 for 2022), $523,051 for heads of household ($488,501 for 2022), and $553,851 for couples filing jointly ($517,201 for 2022).

The 15% rate is for filers with taxable incomes between the 0% and 20% breakpoints.

The 3.8% surtax on net investment income stays the same for 2023. It kicks in for single people with modified adjusted gross income over $200,000 and for joint filers with modified AGI over $250,000.

Charitable Contributions

This has become one of the most effective ways for individuals to utilize personal expenses as a tax deduction. Since the passage of the TCJA, most personal expenses are either subject to limitations (medical and taxes) or are non-deductible. If you find yourself in a high-income year, or are on the cusp of itemizing, consider increasing donations.

Qualified Charitable Distributions

Are you required to make distributions from your IRA but don’t want to? If you are 70½ or older, you have the option to transfer up to $100,000 of your IRA distribution to a charity. Any donation amounts up to $100,000 are treated as non-taxable to you. Additionally, if you are 72 or older, your QCD counts toward your required minimum distribution for the year.

529 Plan Contributions

These plans are a great way to save for future education costs. While contributions to these plans are not deductible on your federal return (many states, including Arizona, have a deduction) the money grows tax-free and distributions for qualifying educational expenses are not taxable. And, in addition to higher education costs, funds in these accounts can be used to cover private school tuition of up to $10,000 per year.